How hybrid quantum-classical systems are solving real problems — and what it means for federal missions and investors.

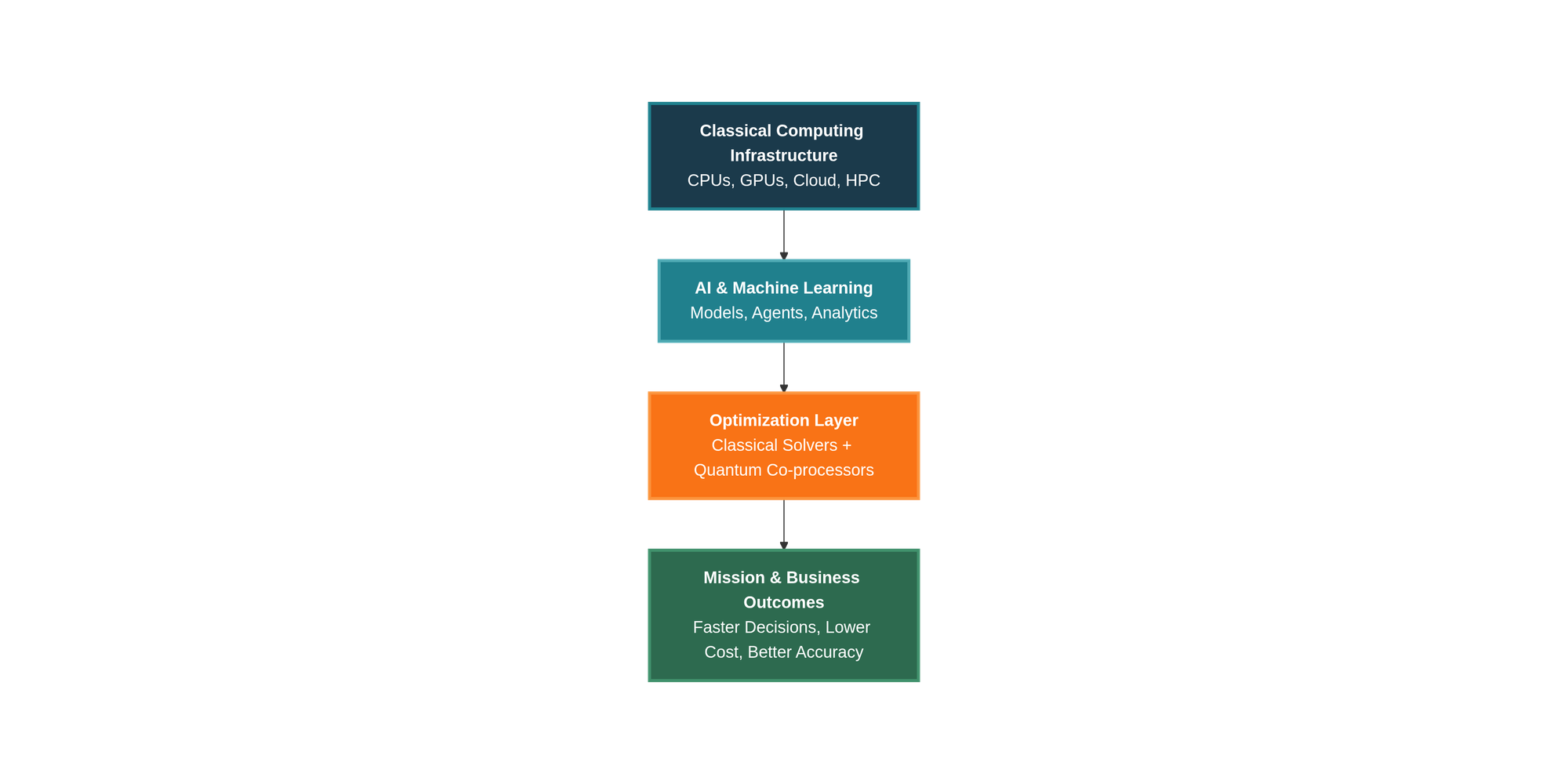

Artificial intelligence has reshaped how we extract patterns from data and automate decision-making, but AI models still run on classical hardware — and that hardware has limits. Training large models is compute-intensive. Inference at scale is expensive. And when organizations need to move from prediction to action — finding the single best configuration among billions of possibilities — they hit a different kind of wall.

These are optimization problems: routing vehicles across a supply network, scheduling manufacturing lines with hundreds of constraints, assigning missile interceptors to incoming threats in real time. Classical computers attack these problems sequentially, testing one solution at a time. As variables multiply, even the most powerful supercomputers slow to a crawl or simply cannot reach optimal solutions within useful timeframes.

This is where quantum computing enters — not as a replacement for classical systems or AI, but as an accelerator that tackles the combinatorial explosion neither can handle efficiently on its own.

How Quantum Acts as an Accelerator

Quantum annealing, the approach pioneered by D-Wave, works by mapping optimization problems onto a physical quantum system that naturally settles into its lowest-energy state — the optimal or near-optimal solution. Unlike classical methods that climb through solution landscapes step by step, quantum systems exploit quantum tunneling to explore the entire landscape simultaneously, escaping local traps that strand classical solvers.

The critical insight for 2026 is that practical quantum optimization is hybrid. D-Wave's Stride hybrid solver combines annealing quantum processors with classical computing, deploying the quantum processing unit (QPU) precisely where classical methods hit combinatorial walls. Think of it as adding a QPU alongside GPUs and CPUs in the computing stack — each handles what it does best. D-Wave's VP of Advanced Computing, Irwan Owen, stated: "The combination of QPUs plus GPUs and CPUs working together has transformative potential".

This hybrid model is also converging with AI. Stride now integrates machine learning models directly into quantum optimization workflows, enabling use cases where AI generates forecasts and quantum finds the optimal action. Partners like TRIUMF (Canada’s particle accelerator center) have demonstrated significant speedups using D-Wave’s QPU for simulating particle interactions, while Honda and Tohoku University showed improved accuracy in training restricted Boltzmann machines with quantum-fine-tuned sampling. Customer adoption reflects this momentum: Advantage2 usage surged 314% year-over-year, while Stride usage climbed 114% in six months.

But annealing is one approach within a broader quantum ecosystem. Gate-based quantum computing — pursued by Quantinuum and IonQ (trapped-ion), IBM and Google (superconducting), and photonic players like PsiQuantum and Xanadu — targets a different class of problems: molecular simulation, drug discovery, materials science, and cryptanalysis. IBM is targeting a fault-tolerant system by 2029; Quantinuum aims for universal fault tolerance by 2030. These systems will eventually solve problems annealing cannot — but for the optimization challenges that dominate enterprise and government operations today, hybrid quantum-classical solvers are delivering measurable results now.

Production Results: From Hours to Seconds

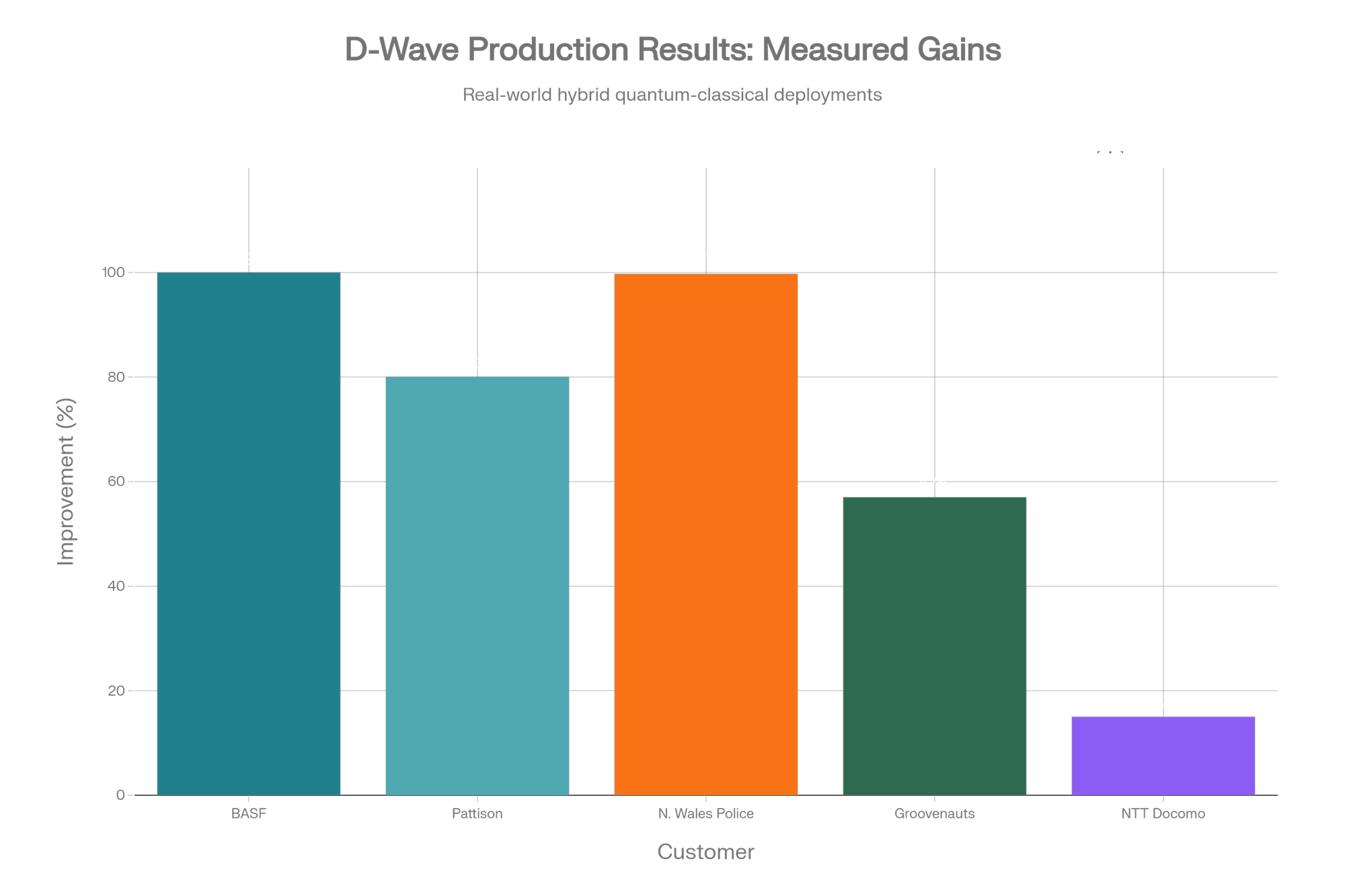

The strongest case for quantum-as-accelerator isn't theoretical — it's operational. Organizations are running D-Wave's hybrid systems in production today and measuring the difference:

- BASF reduced production scheduling at a liquid-filling facility from 10 hours to 5 seconds, while cutting lateness by 14% and setup times by 9%.

- Pattison Food Group compressed weekly delivery driver scheduling from 80 hours to 15 hours — an 80% reduction in manual effort.

- Groovenauts and Mitsubishi Estate optimized waste-collection routes, cutting CO₂ emissions by 57% and reducing the number of vehicles needed by 59%.

- NTT Docomo reduced base station paging signals by up to 15%, easing network congestion.

- D-Wave, Davidson Technologies, and Anduril Industries demonstrated a missile defense proof-of-concept, achieving 10x faster solution times with 9–12% better threat mitigation.

These aren't benchmarks or simulations. They are production deployments that solve real operational problems, problems that classical solvers couldn't handle at the same speed or quality.

Federal Government: From Research to Mission Deployment

Having spoken on quantum computing’s role in public sector missions at D-Wave’s Qubits 2026 conference — alongside leaders from George Mason University and North Wales Police — I can attest that the conversation has shifted decisively.

Manish Malhotra: Panelist D-Wave Qubits 2026 Conference, Boca Raton, FL

Federal momentum is building on multiple fronts:

- Policy: The White House's proposed executive order titled "Ushering In The Next Frontier Of Quantum Innovation" that establishes a whole-of-government quantum strategy, coordinates federal investment, launches a federally backed scientific quantum computer at a DOE facility, and expands workforce development.

- Legislation: The National Quantum Initiative Reauthorization Act of 2026 is advancing in Congress, directing billions into quantum R&D across NIST, NSF, and DOE—while adding provisions for quantum applications, supply chain security, and post-quantum cryptography.

- Defense & Intelligence: The Department of Defense invested $140 million in the Quantum Proving Ground in Illinois. DARPA's Quantum Benchmarking Initiative is evaluating whether utility-scale systems will be defense-ready by 2033. The Defense Logistics Agency is actively testing quantum optimization for supply chain and parts sourcing decisions. The missile defense proof-of-concept with D-Wave, Davidson, and Anduril demonstrates that quantum-classical hybrids can enhance national security operations today.

- Civilian Agencies: FY27 R&D priorities place AI and quantum at the top of the federal research agenda, with healthcare optimization, border biometrics, and manpower allocation in active exploration.

- Workforce: Federal officials warned Congress in January 2026 of a “plain and simple” quantum workforce shortage. The draft executive order directs NSF to establish National Quantum Education Institutes.

The strategic competition dimension cannot be ignored. China has invested over $15 billion across quantum programs, deployed the world’s largest quantum communication network spanning 17 provinces and 80 cities, and is accelerating commercialization through state-coordinated industrial programs. The U.S.-China Economic and Security Review Commission warned in November 2025 that “whoever gets there first could lock in irreversible strategic superiority” — making quantum not just an innovation priority but a national security imperative.

The broader ecosystem extends beyond computing. Quantum sensing — atomic clocks, magnetometers, inertial navigation — is already deployed in defense contexts. Post-quantum cryptography demands particular attention: NIST finalized three quantum-resistant encryption standards in 2024, and federal agencies are incorporating PQC requirements into procurement. The urgency stems from “harvest now, decrypt later” attacks — adversaries collecting encrypted data today to decrypt once quantum computers mature. For agencies managing classified data, PQC migration is an active requirement, not a future concern.

Why Investors Should Watch: The Opulentia Perspective

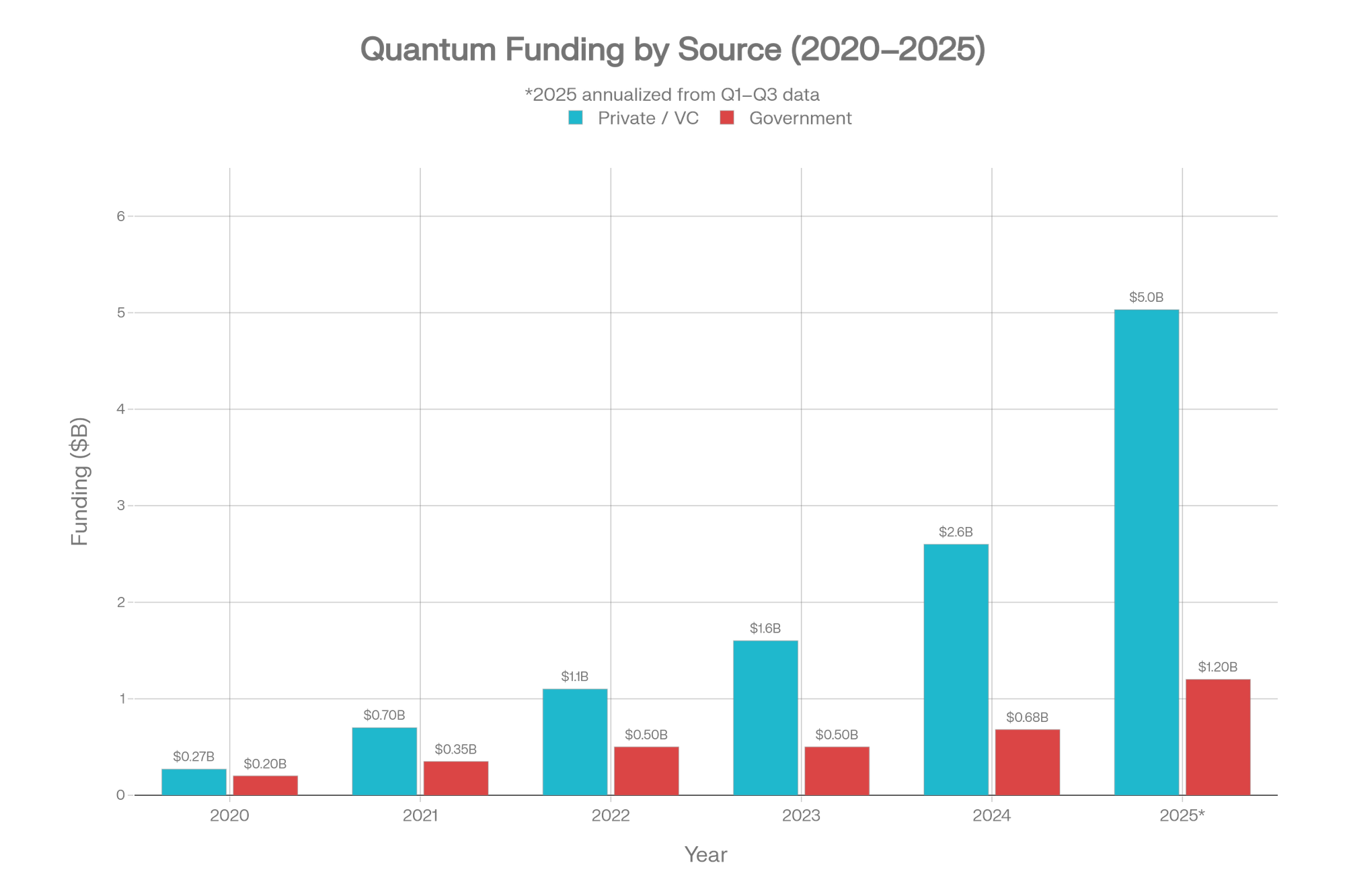

The investment community has crossed the threshold from speculative deep-tech bet to a sector with structural investment characteristics worth serious evaluation.

Market scale is confirmed. The global quantum computing market reached $2.7 billion in 2024 and is projected to hit $20.2 billion by 2030 at a 41.8% CAGR, with longer-term estimates ranging from $45–$131 billion by 2040. McKinsey projects the three quantum pillars — computing, communication, and sensing — could generate $97 billion in revenues by 2035. BCG estimates quantum computing will create $450–$850 billion in global economic value by 2040.

Capital formation is accelerating. Quantum startups raised $3.77 billion through Q3 2025, with Q1 alone surging 128% year over year. PsiQuantum closed a $1 billion Series E, Quantinuum raised $600 million at a $10 billion valuation, and IonQ completed the sector's largest acquisition at $1.08 billion. The funding mix is shifting — government participation in quantum startup investment rose 19 percentage points between 2023 and 2024, creating a more resilient capital base.

The public-market window is opening. Quantinuum filed a confidential S-1 in January 2026, Infleqtion completed its NYSE listing in February, and Xanadu's SPAC is expected to close in H1 2026. For private investors, these exits signal a maturing liquidity path. Novo Holdings — the investment arm behind Novo Nordisk — committed €188 million to quantum-AI-life sciences convergence, where quantum's most immediate value emerges at the intersection of AI, biomedical research, and industrial optimization.

The investment timeline maps to quantum modalities: annealing and hybrid solvers are in production now; gate-based systems are targeting quantum advantage demonstrations by 2027; fault-tolerant quantum computers are expected by 2029–2030, unlocking the full addressable market in simulation, drug discovery, and cryptography.

Risks remain real. Quantum stocks experienced significant sell-offs in January 2026 amid broader tech volatility — a reminder that these remain high-beta, pre-profit investments. Hardware scalability challenges persist, timelines could slip, and the question of which modality will achieve commercial scale remains unresolved. Investors should calibrate position sizing to reflect both asymmetric upside and genuine execution risk.

For portfolio evaluation, three questions matter: Which companies are generating production revenue from quantum today (not just research contracts)? Which quantum modalities—annealing, trapped-ion, superconducting, photonic—are best positioned for near-term commercial value versus long-term transformative potential? And which enablers—semiconductor fabricators, cryogenics suppliers, control electronics, quantum software platforms—will capture value regardless of which hardware modality wins?

Quantum computing is no longer a speculative laboratory technology. It is an emerging infrastructure layer—one that accelerates classical computing and AI in exactly the places where they hit their limits. The investment window is open, and the evidence base is growing.

About Opulentia Ventures

Opulentia Ventures operates as a “VC Tribe” consolidating resources from experienced investors to support pioneering companies focused on technological advancements, healthcare, and national security. Headquartered in the Washington, DC, metro area, the firm leverages deep government and defense-sector relationships to identify emerging opportunities at the intersection of innovation and national priorities.