From certificate verification to exit scenario modeling—the execution playbook that transforms analysis into disciplined capital deployment.

The Execution Challenge

The pre-IPO investment landscape continues to grow explosively. Secondary market transaction volumes surged to a record $162 billion in 2024, with volumes exceeding $210 billion in 2025—creating unprecedented access to late-stage private companies for accredited investors.

In Part I of this framework, we examined how institutional investors evaluate pre-IPO companies—from fundamental business analysis through financial valuation and legal structure review. We established that fraud prevention, valuation discipline, and cap table forensics form the foundation of pre-IPO due diligence.

Read Part I: Company Fundamentals, Valuation & Legal Analysis

But understanding *what* you're buying is only half the equation.

Even the most compelling company at an attractive valuation can become a capital trap if:

• The transaction itself is structurally flawed or fraudulent

• Share certificates cannot be verified or transferred

• The investment creates excessive portfolio concentration

• Exit timelines extend beyond liquidity requirements

• Market conditions shift dramatically after capital deployment

This is where execution discipline separates institutional investors from amateur participants. Part II completes the framework with the operational verification, risk modeling, and portfolio construction principles that transform analysis into disciplined capital deployment.

Part I covered the analytical foundation:

Stage One: Company Fundamentals (business model, team, competitive positioning)

Stage Two: Financial Analysis & Valuation (VC Method, comparables, DCF)

Stage Three: Legal & Compliance Review (cap table, transfer restrictions, regulatory compliance)

Now we examine Stages Four and Five—the execution and portfolio fit analysis that determines whether opportunities proceed to capital deployment.

Stage Four: Transaction Verification & Ownership Confirmation

Legal structure analysis addresses what investors receive. Transaction verification addresses whether the transaction is operationally sound and whether parties facilitating it are reputable and properly registered.

Broker-Dealer & Platform Verification

Securities transactions in the United States must be conducted by registered broker-dealers unless an exemption applies. Investors should verify that platforms or intermediaries facilitating transactions are FINRA-registered and check for any disciplinary history or regulatory complaints.

Key verification steps:

• FINRA BrokerCheck: Search the broker-dealer's CRD number to confirm registration status and review any disclosed disciplinary actions, customer disputes, or regulatory sanctions

• Platform legitimacy: Verify the platform's legal entity, operational history, and whether it operates as a registered funding portal, broker-dealer, or transfer agent

• Fee transparency: Understand all transaction costs, including platform fees, transfer agent fees, legal documentation fees, and any ongoing custody or administrative charges

Unregistered intermediaries or platforms with opaque fee structures signal elevated fraud risk.

Certificate Verification & Ownership Authentication

Certificate verification deepens at the transaction stage to confirm that the specific shares being purchased match the shares described in the offering documents:

• Certificate numbers and quantities: Do certificates presented match the subscription agreement exactly?

• Transfer agent coordination: Has the transfer agent confirmed that shares can be transferred, and are there any stop-transfer orders in place that would prevent the transaction?

• Escrow and settlement mechanisms: Who holds shares during the transaction, and what protections ensure simultaneous exchange of shares and payment?

• Medallion Signature Guarantee: For physical certificates, verify the seller has obtained proper signature guarantees that authenticate the transfer

These operational details seem mundane but determine whether transactions execute as agreed or become mired in disputes and delays.

Before releasing capital:

✓ Transfer agent confirms seller ownership

✓ Certificate serial numbers verified against company records

✓ ROFR/transfer approval obtained in writing

✓ Escrow account established with clear release conditions

✓ All fees disclosed and documented

✓ Settlement timeline and mechanics confirmed

Missing any single element creates execution risk that can delay or derail the entire transaction.

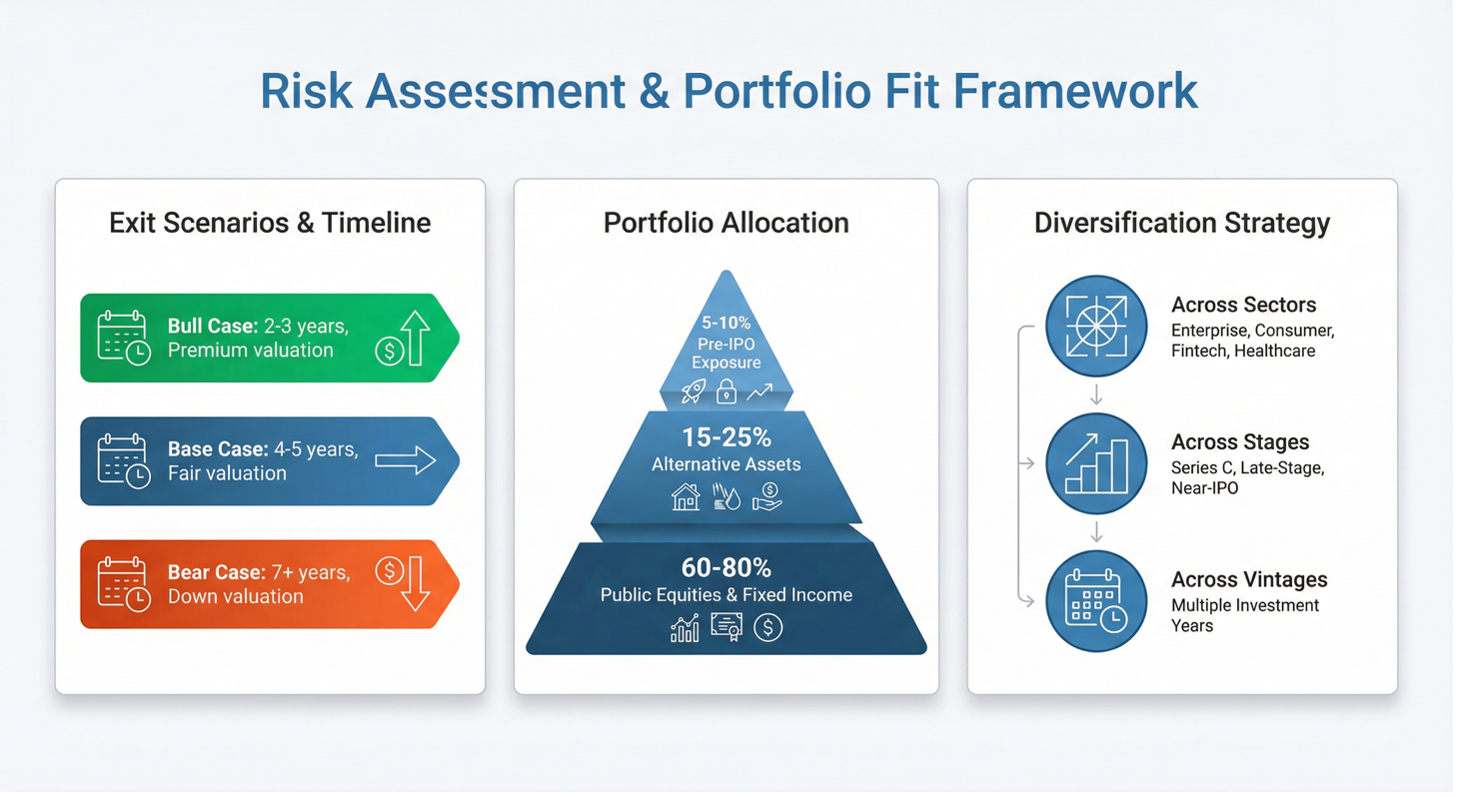

Stage Five: Risk Assessment & Portfolio Fit

The final stage integrates all prior analysis into a holistic risk assessment: Does this opportunity align with investment objectives, risk tolerance, and portfolio construction principles?

Liquidity Timeline & Exit Scenarios: Pre-IPO investments are, by definition, illiquid. Even companies that eventually go public may take 3-7 years to reach that milestone, and IPO lock-up periods extend illiquidity by an additional 6-12 months. Acquisitions offer alternative exit paths but introduce different uncertainties—acquirers may offer cash (triggering taxes and ending exposure) or stock (extending illiquidity and introducing new company-specific risk).

The 2025 IPO market illustrates the unpredictability of exit timelines. While IPO activity surged 74% in Q1 2025 compared to Q1 2024, geopolitical uncertainties and macroeconomic volatility tempered expectations throughout the year. Companies that expected to go public in favorable 2025 conditions may now delay until 2026 or beyond. For investors, this means capital may be locked up longer than initially projected.

Scenario planning requires modeling three outcomes:

- Bull case: Company exceeds growth expectations, IPOs within 2-3 years at a premium valuation

- Base case: Company performs as expected, exits within 4-5 years at a fair valuation

- Bear case: Company underperforms, delays exit to 7+ years, or exits at a down valuation

Understanding the probability-weighted return across these scenarios—and confirming that even the base case delivers acceptable returns—is essential before committing capital.

(At Opulentia, this discipline has led us to pass on more opportunities than we’ve backed.)

Market Conditions & Sector Timing: Pre-IPO investments are exposed to public market conditions even before exit events. If public market multiples compress (as they did in 2022-2023), private company valuations follow with a lag. Investors who purchased at peak private valuations may face mark-to-market losses even if the underlying company executes well.

Portfolio Concentration & Diversification: Pre-IPO investments carry binary risk profiles—companies either succeed and generate multiples of invested capital, or they fail and return little to nothing. Concentration in a single pre-IPO investment (or even a small number of correlated investments) magnifies this risk.

Institutional portfolio construction principles suggest that pre-IPO exposure should represent a minority allocation within alternative assets, which themselves represent a minority allocation within total portfolios. Exact percentages depend on individual risk tolerance, but a common framework allocates:

• 5-20% of total portfolio to alternative assets

• 20-40% of alternative allocation to pre-IPO investments

(your allocations might be different depending on your risk profile and investment strategy)

Diversification across:

- Sectors: Enterprise software, energy, consumer, deep tech, health tech, defense tech (amongst others)

- Stages: Series A-C vs. late-stage pre-IPO vs. near-IPO

- Vintages: Spreading investments across multiple years to reduce timing risk

Finally, investors should assess how a new pre-IPO investment affects existing portfolio exposures. Adding a third Health Tech position may increase sector concentration risk, even if the individual company is high-quality. Balancing diversification with conviction is the art of portfolio construction.

Putting It All Together: The Complete FrameworkThe five-stage framework outlined across Parts I and II represents institutional-grade discipline for pre-IPO investing. From fundamental business analysis through transaction verification and portfolio construction, the process is time-intensive—often requiring weeks of analysis, reference calls, legal review, and verification before capital deployment.

Many opportunities are disqualified at early stages, not because they lack growth potential, but because they fail to meet standards on fundamentals, valuation discipline, transaction integrity, or portfolio fit.

This rigor serves a dual purpose: protecting investors from fraud, overvaluation, and structural risks while identifying opportunities where information asymmetry creates mispriced entry points. The goal isn't to access every pre-IPO deal—it's to access only those opportunities that meet institutional standards for risk-adjusted return potential.

Understanding this framework transforms the relationship with pre-IPO opportunities. Rather than evaluating deals based on brand recognition (access to a "hot" company) or headline valuations (the billion-dollar unicorn narrative), disciplined investors assess fundamentals, verify transaction integrity, and ensure alignment with long-term portfolio objectives.

Key Takeaways for Investors

Pre-IPO investing offers asymmetric upside for those who approach it with institutional discipline:

Fraud prevention is the foundation: Certificate verification and transfer agent confirmation are non-negotiable first steps.

Valuation requires multiple lenses: No single valuation method is definitive. Triangulating across VC Method, comparables analysis, and DCF—while understanding the limitations of each—provides a probability-weighted view of fair value.

Legal structure determines risk: Common vs. preferred shares, liquidation preferences, and transfer restrictions affect both economics and liquidity. Understanding the full capital structure is essential.

Transaction verification prevents operational failures: Broker-dealer registration, certificate authentication, and proper escrow mechanisms separate legitimate transactions from fraudulent schemes.

Liquidity is uncertain, not guaranteed: IPO timelines lengthen and shorten based on market conditions beyond any company's control. Investors must be prepared for 5-7 year hold periods even when initial expectations are shorter.

Diversification mitigates binary risk: Pre-IPO investments produce concentrated outcomes. Portfolio-level diversification across sectors, stages, and vintages reduces the impact of individual failures.

In Summary

For investors evaluating pre-IPO opportunities, the message is clear: due diligence is not a cost to minimize—it is the competitive advantage that separates sustainable wealth creation from speculative gambling.

The five-stage framework provides the systematic approach that institutional investors use to evaluate private companies (Part I) and execute transactions within disciplined portfolio strategies (Part II). Each stage serves as both a filter and a discovery mechanism—eliminating structural traps while surfacing opportunities where information asymmetry creates entry points unavailable to less-disciplined participants.

Pre-IPO investing will continue to grow as companies remain private longer and secondary markets mature. Those who approach this asset class with institutional rigor, systematic frameworks, and disciplined execution will capture the asymmetric returns that define generational wealth creation.

Those who chase headlines, bypass verification, and ignore portfolio construction principles will learn expensive lessons about the difference between access and opportunity.

Disclaimer: This article is for educational purposes only and does not constitute investment advice. Pre-IPO investments carry substantial risk, including the potential for total loss of invested capital, illiquidity, and long holding periods. Past performance is not indicative of future results. Investors should conduct their own due diligence and consult with qualified financial, legal, and tax advisors before making investment decisions.